Kazi Abul Monsur#

Finance Adviser Salehuddin Ahmed said, “Everyone is happy when the stock market index rises. But when the market goes too high, we need to be cautious. Sometimes, problems in the stock market arise due to the wrong policies of the regulatory bodies, and ordinary investors get hurt. In past experiences, I have seen that when banks invested heavily in the market, it drove the market up. Then, suddenly, the Bangladesh Bank instructed the banks to reduce their investments, which caused damage to the market.”

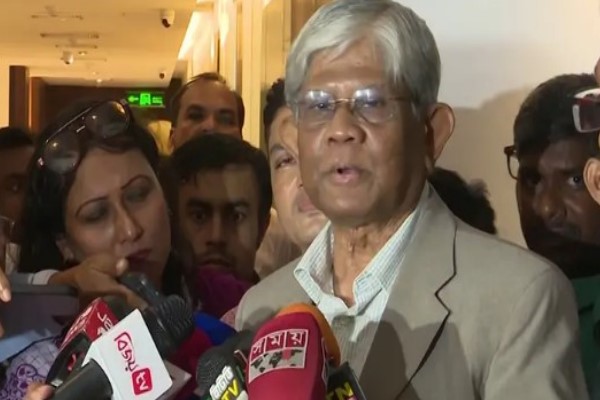

He made these comments during a meeting with stakeholders of the stock market on Tuesday (January 7). On this day, for the first time in history, the Finance Adviser visited the Dhaka Stock Exchange.

The ongoing downturn in the stock market has led the regulatory bodies of the capital market to hold multiple rounds of meetings with stakeholders. The Finance Adviser also visited the Bangladesh Securities and Exchange Commission (BSEC).

As part of this, for the first time in history, a head of the Ministry of Finance visited the Dhaka Stock Exchange to hold a meeting. He discussed the overall situation with market participants.

The Finance Adviser said that the current poor condition of the stock market is temporary due to reforms. Once the reforms are completed, the market will improve.

He further stated that in the long run, the balance between banks and the capital market will be maintained. Additionally, good public and private companies will be listed, and the market will naturally improve through good shares.

Salehuddin Ahmed mentioned, “Our stock market has very little depth. Good companies are not very eager to come to this market. The owners of these companies think their children will become directors, and their wives will be chairpersons. They will enjoy the profits themselves. Coming to the stock market means better management, corporate governance, etc. But many do not want to face questions about these matters, so they are not interested in entering the market. However, it is time to increase the depth of the market. For that, good companies must be brought to the market. The government will consider providing tax benefits and other policy supports for this.”

The Finance Adviser said, “There is a significant lack of coordination among regulatory bodies in our country. There is also a lack of collective initiative to work for the welfare of the country. The coordination or communication between the Bangladesh Bank and the stock market regulatory body, the BSEC, has decreased compared to before. For the sake of the stock market, this communication and coordination must be increased, and all market-related parties must come forward to work collectively.”

Salehuddin Ahmed also called on the DSE and other stock market-related bodies to take initiatives to increase investments from expatriate Bangladeshis in the stock market. He said, “India’s stock market has significant investments from its expatriates. Many expatriate Bangladeshis also have the capacity to invest. We need to encourage them to invest, and for that, the market must be made attractive.”

The discussion was chaired by DSE Chairman Mominul Islam, with speeches from BSEC Chairman Khondokar Rashed Maksud. Also present were BSEC commissioners, senior officials, and top executives from DSE and brokerage houses.##

মন্তব্যসমূহ বন্ধ করা হয়.